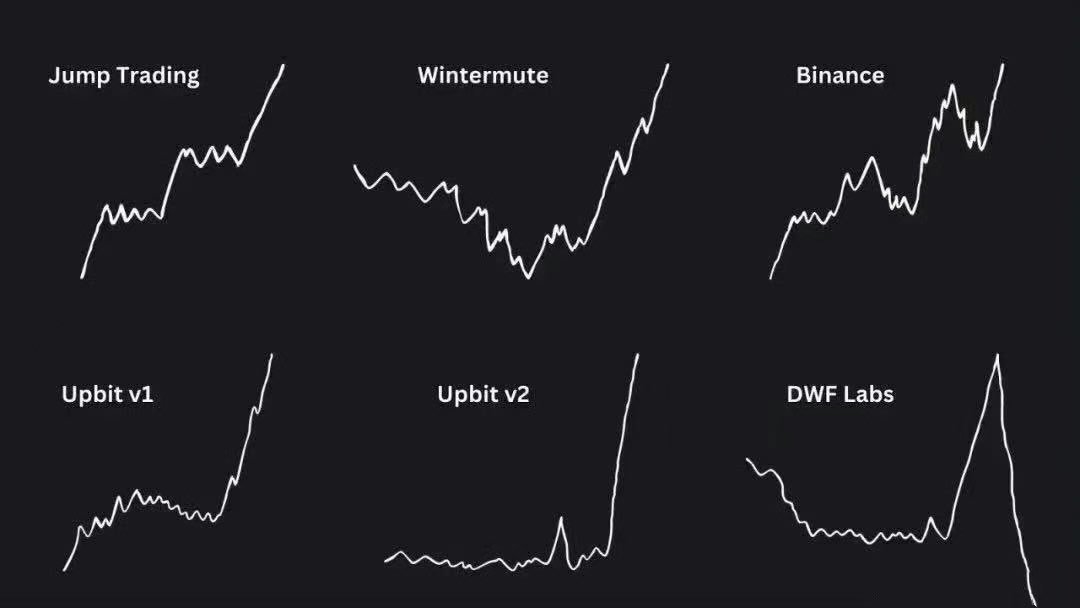

From September 2 to now, the spot trading volume of $WLFI: coinbase 1.35b, binance 1.19b, huobi 0.39b. Aside from other CEXs, do you believe that Sun Yuchen is using $WLFI on Huobi to crash the market? After the crash, there are still nearly 3 billion tokens that can be locked... I looked it up online and found that Sun Yuchen holds a total of 3,000,042,574 $WLFI. Coinmarketcap shows that the circulating supply of $WLFI is 24.66B. Even if Sun Yuchen holds a few hundred million more, it can't crash a truly valuable market. So ultimately, the question is how much $WLFI is really worth. It's not that the market cap of $WLFI isn't worth 6 billion dollars, nor is it that the FDV of $WLFI isn't worth 23 billion dollars. It's that it has overdrawn its future, and right now it hasn't realized that value yet. This principle should be understood by most people, so the return to value is a normal occurrence. Truly: Tokens rise and fall in their own time, Why should Trump blame Yuchen? If...

$WLFI is not a MEME, so why should we think it is different from VC coins? ┈┈➤ Consider Market Cap Previously, WLFI's market cap exceeded UNI's, and now it has fallen back to before UNI, but it is still higher than AAVE and ENA. It is important to note that these DeFi ecosystems have products, users, TVL, and even innovations. Of course, we can consider that WLFI's background can offset or even surpass innovation. However, this background should gradually play an advantage during the project's operation process, leading to growth. The short-term impact can only be emotional, and emotional impacts often recede. In addition to innovation, products, users, ecosystems, and TVL, all these #WLFI may have in the future, but it requires time. Therefore, WLFI may be similar to VC coins, and evaluating its value based on project fundamentals, excluding the time factor, may be reasonable. However, considering the time factor, the market cap may have been advanced or even overdrawn. ┈┈➤...

50.72K

62

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.