Our latest Enterprise research covers:

- Why Plasma was valued on its connection to Tether.

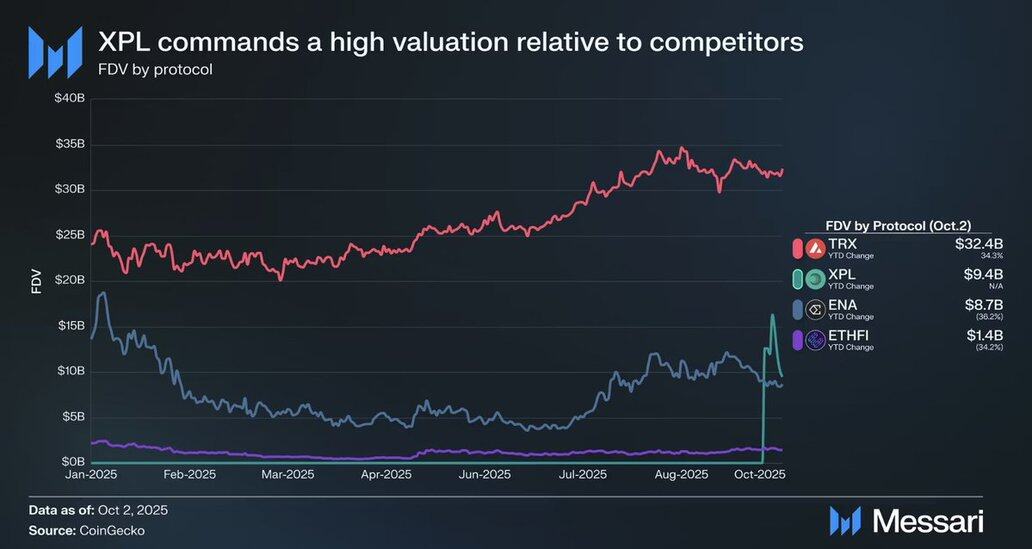

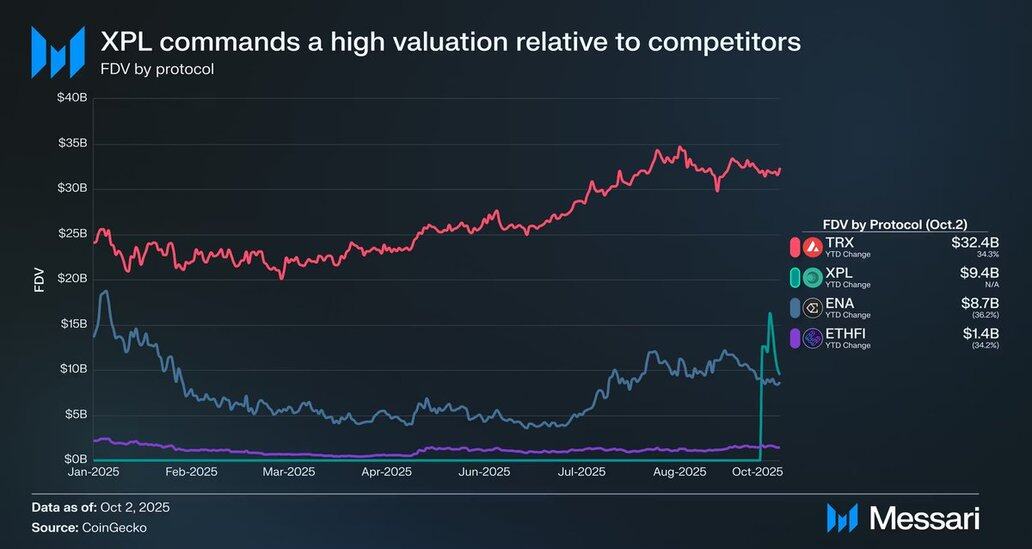

- How to value Plasma based on comparable protocols (TRX, ENA, ETHFI).

- Plasma's best path forward is to build a neobank.

Read now:

$XPL is caught in a tricky spot.

Investors were eager to treat @Plasma as a proxy to Tether, but at a $10 billion valuation, the market appears to be overpricing its ability to monetize that alignment.

Ultimately, Plasma’s success depends less on Tether proximity, or even chain fees, but rather on delivering new value to USDT users through its emerging market-focused neobank.

We believe the market will eventually correct based on Plasma's execution of Plasma One (their custom-built neobank).

29.59K

35

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.